The Story of Flutterwave: Transforming Payments Across Africa

Flutterwave has processed billions of dollars in transactions across 30+ African countries.

Inspiring Startup Story: Flutterwave

Company: Flutterwave

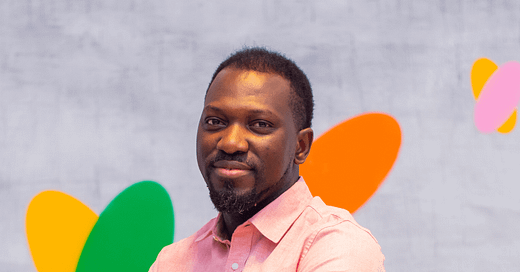

Founders: Olugbenga Agboola, Iyinoluwa Aboyeji, and others

Year Founded: 2016

Headquarters: San Francisco, USA, and Lagos, Nigeria

Flutterwave is one of Africa’s most celebrated tech startups, reshaping how payments are made across the continent. Born out of the need to simplify and connect Africa’s fragmented payment systems, the company has grown into a powerhouse, empowering businesses to accept and process payments seamlessly.

The Beginning: Solving a Complex Problem

In 2016, Olugbenga Agboola (a seasoned engineer and entrepreneur) and Iyinoluwa Aboyeji (co-founder of Andela) realized that Africa’s payment ecosystem needed a unifying platform. The problem was clear: Africa’s financial systems were fragmented, making it hard for businesses to accept and send payments across borders.

Their solution was Flutterwave, a platform that would act as the “infrastructure for payments in Africa,” connecting various payment methods—cards, mobile money, and bank transfers—into one seamless system.

From day one, the company focused on building a robust and developer-friendly platform. Its APIs made it easy for businesses to integrate payment processing into their operations, enabling even small merchants to participate in the digital economy.

Early Growth and Global Recognition

Flutterwave quickly gained traction by helping businesses across Africa process payments in multiple currencies. Its platform made it possible for merchants to sell products and services globally while receiving payments locally.

In 2017, Flutterwave joined Y Combinator, one of the world’s most prestigious startup accelerators. This partnership provided funding, mentorship, and exposure, setting the company on a path to global recognition.

Over the years, Flutterwave grew its footprint, expanding from Nigeria to other African countries like Kenya, Ghana, and South Africa. The company also launched Rave, a product that allowed merchants to accept payments across multiple channels, including cards, mobile money, and USSD.

Challenges: Navigating a Complex Landscape

Building a payment platform in Africa is no easy task. Flutterwave had to navigate complex regulatory environments across different countries, deal with security concerns, and compete with established players in the fintech space.

In addition, growing rapidly came with internal challenges, including scaling the team, maintaining product quality, and managing relationships with financial institutions. Despite these hurdles, Flutterwave remained focused on its mission to simplify payments for businesses and individuals.

Big Breaks and Milestones

Enabling Global E-Commerce: During the COVID-19 pandemic, Flutterwave helped small businesses transition to online sales through its Flutterwave Store, a platform that allowed merchants to set up online stores for free.

Strategic Partnerships: Flutterwave collaborated with global giants like PayPal, enabling African merchants to receive payments from over 200 countries.

Funding Success: By 2022, Flutterwave had raised over $475 million in funding, making it one of Africa’s most valuable startups.

Event Payments: The company processed payments for major events like Afronation and supported businesses in tourism and entertainment, two critical sectors in Africa.

Achievements and Impact

Expanding Financial Inclusion: Flutterwave has empowered millions of small businesses to participate in the digital economy.

Processing Billions: The company has processed billions of dollars in transactions across 30+ African countries.

Job Creation: Flutterwave’s success has created jobs both directly and indirectly, stimulating growth in the fintech ecosystem.

Empowering Entrepreneurs: Through products like the Flutterwave Store, the company has made it easier for entrepreneurs to reach global customers.

What We Can Learn from Flutterwave

Think Big, Start Local: Flutterwave started by addressing Africa’s unique challenges but designed its platform to compete globally.

Partnerships Matter: Collaborations with PayPal, Y Combinator, and other global companies helped Flutterwave scale and gain credibility.

Adaptability: By launching tools like the Flutterwave Store during the pandemic, the company demonstrated its ability to respond to market needs.

Resilience: Building a fintech company in Africa requires navigating regulatory complexities and infrastructure gaps. Flutterwave’s persistence is a lesson for all entrepreneurs.

The Future of Flutterwave

Flutterwave aims to become the "Amazon of Payments" for Africa, enabling seamless transactions not only within the continent but between Africa and the rest of the world. With its innovative solutions and growing footprint, the company is poised to remain at the forefront of Africa’s fintech revolution.

Flutterwave’s story is a powerful reminder that solving local problems with innovative technology can lead to global success. As it continues to transform payments, Flutterwave is empowering a new generation of African businesses to thrive in the digital economy.

To Ship Products or packages to your customers locally or internationally use YD package delivery service

Before you go please check our WhatsApp channel and subscribe here